Content

Enter the original price, depreciation % per year, and the number of years into the calculator to determine the salvage value. This calculator can also determine the original price, depreciation rate, or asset age given the other variables are known. A salvage value of zero is reasonable since it is assumed that the asset will no longer be useful at the point when the depreciation expense ends. Even if the company receives a small amount, it may be offset by costs of removing and disposing of the asset. When this happens, a loss will eventually be recorded when the assets are eventually dispositioned at the end of their useful lives. Auditors should examine salvage value levels as part of their year-end audit procedures relating to fixed assets, to see if they are reasonable.

- For tax purposes, businesses are generally required to use the MACRS depreciation method.

- These include white papers, government data, original reporting, and interviews with industry experts.

- The salvage company decides what parts be resold, and these pieces are then separated from the car.

- While not overtly bad on the surface, an inappropriate calculation can severely increase the impact of salvage value on depreciation.

- If we assume the value to be zero, then there would be no chance of a reduction in the depreciation amount.

Salvage value is the estimated resale price for an asset after its useful life is over. Here’s how to determine a fixed asset’s salvage value.Every few years, I go to the Apple store and turn my wallet upside down to get the newest iPhone. It’s always a pleasant surprise when they hand me a couple of hundred dollars back to trade in my current one. When calculating depreciation, an asset’s salvage value is subtracted from its initial cost to determine total depreciation over the asset’s useful life. From there, accountants have several options to calculate each year’s depreciation.

Prime Cost Depreciation Method

Use this calculator to calculate the simple straight line depreciation of assets. Conceptually, depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. It would be best to multiply the car’s market value determined earlier by 0.25 to find its salvage value. The result will always be lower than the current market value of the vehicle.

Capitalized assets are assets that provide value for more than one year. Accounting rules dictate that revenues and expenses are matched in the period in which they are incurred. Depreciation is a solution for this matching problem for capitalized assets because it allocates a portion of the asset’s cost in each year of the asset’s useful life. The salvage value is necessarily an estimate of an asset’s value after it has been used over a period of time. A common method of estimating an asset’s salvage value is to estimate how much the asset could be sold for.

Buy slightly damaged cars from Salvage King online

Some companies may choose to always depreciate an asset to $0 because its salvage value is so minimal. In general, the salvage value is important because it will be the carrying value of the asset on a company’s books after depreciation has been fully expensed. It is based on the value a company expects to receive from the sale of the asset at the end of its useful life. In some cases, salvage value may just be a value the company believes it can obtain by selling a depreciated, inoperable asset for parts.

Instead of appearing as a sharp jump in the accounting books, this can be smoothed by expensing the asset over its useful life. Within a business in the U.S., depreciation expenses are tax-deductible.

Recommended Articles

If your business owns any equipment, vehicles, tools, hardware, buildings, or machinery—those are all depreciable assets that sell for salvage value to recover cost and save money on taxes. Depreciation is a way for businesses to allocate the cost of fixed assets, including buildings, equipment, machinery, and furniture, to the years the business will use the assets. Residual value refers to the estimated worth of an asset after the asset has fully depreciated.

It is clear that the amount of wear and tear on an asset can significantly affect its salvage value. In other words, it is not simply the length of time an asset is in use that affects its potential resale value. The way an asset has been operated, used, and otherwise maintained during its useful life can have a salvage value formula real effect on its future market value. Such considerations may affect a company or individual’s decision whether to lease or buy an asset. An individual may decide it is better financially to purchase a car than lease it if he or she believes it will have a higher resale value than is assigned by the dealer.

In some cases, accountants will place an asset’s salvage value at zero. This removes the need for determining what a company can sell an asset for in a future time period. In some cases, the company may have to write off any residual salvage value once it sells the asset. Poor salvage value estimates can result in a significant one-time expense that will reduce net income. This is particularly dangerous for publicly held companies, whose stock prices may fall if investors are wary of the lower net income or a loss on operations. Use a depreciation factor of two when doing calculations for double declining balance depreciation. Regarding this method, salvage values are not included in the calculation for annual depreciation.

- Residual ValueResidual value is the estimated scrap value of an asset at the end of its lease or useful life, also known as the salvage value.

- Investment advisory services are offered through Realized Financial, Inc. a registered investment adviser.

- Unlike the other methods, the double-declining balance method doesn’t use salvage value in its calculation.

- Multiply the car’s current market value decided earlier by 0.25, meaning 1.00 minus 0.75, to find its salvage value.

- Depreciation is how the Internal Revenue Service allows you to expense part of an asset’s cost over a number of years.

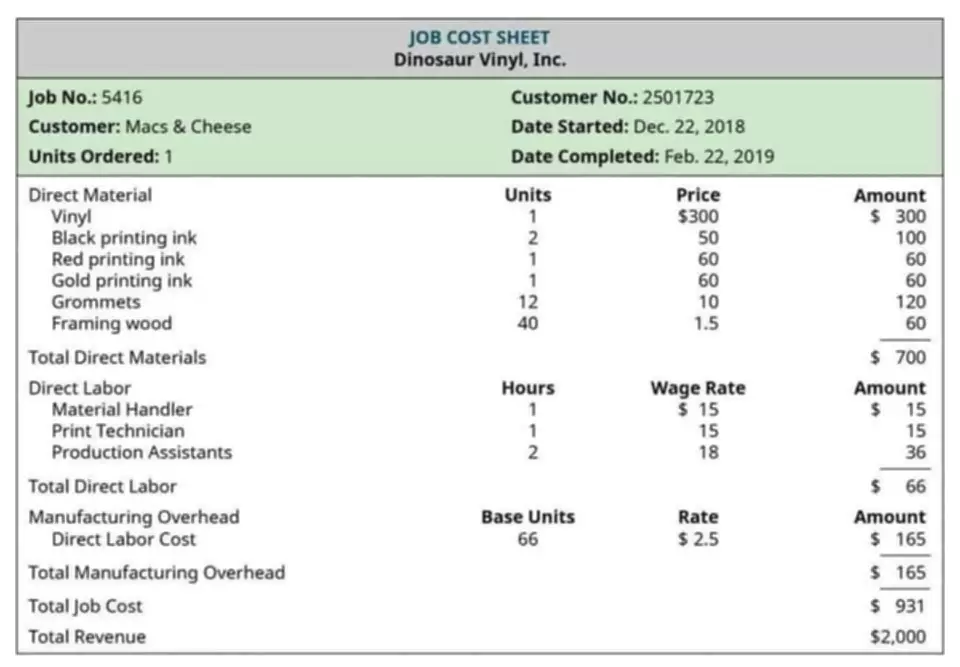

We have been given the asset’s original price in this example, i.e., $1 million. The asset’s useful life is also given, i.e., 20 years, and the depreciation rate is also provided, i.e., 20%. For our example scenario, we’ll assume a company spent $1 million purchasing machinery and tools. The fixed assets are expected to be useful for five years and then be sold for $200k. The annual depreciation is multiplied by the number of years the asset was depreciated, resulting in total depreciation. When salvage value changes, it may cause a change in the amount of depreciation expense you can deduct. If there is a decrease in the salvage value, depreciation expense will increase and vice versa.

How to Calculate Tax Depreciation

Generally, it is ideal for companies to calculate their assets’ residual value at each year’s end. If and when the estimated residual value changes, such changes should be recorded accordingly. The US Income Tax Regulations also ask taxpayers to assume the scrap value of the asset to be zero for calculating depreciation. And, if after the useful life, the asset fetches some value, then we can show it as a gain. Talking of a real-world example, a company by the name Waste Management, Inc did several frauds between 1992 and 1997 by misusing salvage value.

The carrying value, or book value, of an asset on a balance sheet is the difference between its purchase price and the accumulated depreciation. The Excel equivalent function for Straight-Line Method is SLN will calculate the depreciation expense for any period. For a more accelerated depreciation method see, for example, our Double Declining Balance Method Depreciation Calculator. https://quickbooks-payroll.org/ Most businesses opt for the straight-line method, which recognizes a uniform depreciation expense over the asset’s useful life. However, you may choose a depreciation method that roughly matches how the item loses value over time. Sometimes due to better than expected efficiency level, the machine tends to operate smoothly in spite of completion of tenure of expected life.