Content

This information ties back to a balance sheet for a same period; the ending balance on the change of equity statement is equal to the total equity reported on the balance sheet. Investors and financial analysts rely on financial data to analyze the performance of a company and make predictions about the future direction of the company’s stock price. One of the most important resources of reliable and audited financial data is the annual report, which contains the firm’s financial statements. Because of its importance, earnings per share are required to be disclosed on the face of the income statement. A company which reports any of the irregular items must also report EPS for these items either in the statement or in the notes.

The appropriated budget was traditionally used to determine a government’s property tax levy, and a ceiling on expenditures was made absolute so that the expenditures of a government unit would not exceed its revenues. This budget was also historically a balanced budget, estimated revenues equaling appropriations. Appropriated budgets are required by statute in cities (Chapter 35.32A RCW, Chapter 35.33 RCW and Chapter 35A.33 RCW), counties (Chapter 36.40 RCW), and most other local governments in Washington State. These budgets are also called legal budgets, adopted budgets, or formal budgets. The appropriated budgets should be adopted by ordinance or resolution. But, since auditable nonprofit financial statements, we’ll talk about accrual accounting practices in this article.

Overview of Changes

Activities that are not an integral part of an NFP’s usual activities or their gross revenues or expenses are not significant in relation to the NFP’s annual budget. Activities that are a normal part of an NFP’s strategy and it normally carries on such activities or the event’s gross revenues or expenses are significant in relation to the NFP’s annual budget. Certain revenues, less directly related expenses, followed by a subtotal, then other revenues, other expenses, gains and losses, and reclassifications.

What three activities are part of the function of accounting?

All companies use accounting to report, track, execute and predict financial transactions. The main functions of accounting are to store and analyze financial information and oversee monetary transactions. Accounting is used to prepare financial statements for a company's employees, leaders, and investors.

After revision to IAS 1 in 2003, the Standard is now using profit or loss for the year rather than net profit or loss or net income as the descriptive statement of activities term for the bottom line of the income statement. The following income statement is a very brief example prepared in accordance with IFRS.

Statement of Changes in Shareholder Equity

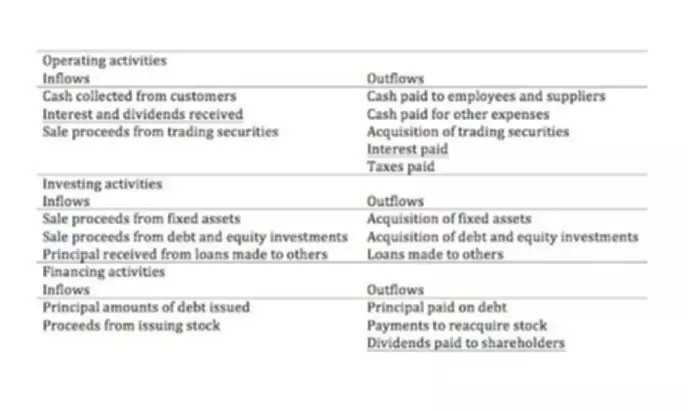

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Cash from financing activities includes the sources of cash from investors or banks, as well as the uses of cash paid to shareholders. Financing activities include debt issuance, equity issuance, stock repurchases, loans, dividends paid, and repayments of debt. The CFS allows investors to understand how a company’s operations are running, where its money is coming from, and how money is being spent. The CFS also provides insight as to whether a company is on a solid financial footing.

- Expenditures should be recognized in the accounting period in which the fund liability is incurred, if measurable, except for unmatured interest on general long-term liabilities, which should be recognized when due.

- Information on the governmental funds typically used to liquidate long-term liabilities in prior years.

- It is not a requirement that the debt be backed solely by pledged revenues.

- Nonprofit organizations must file annual reports with state authorities.

- You’ll not only gain a better understanding of how much money flows into your organization on a monthly basis but also of how much your nonprofit spends monthly.

Code Fiduciary Funds – should be used to account for assets, including capital assets , held by a government in a trustee capacity or as a custodian for individuals, private https://www.bookstime.com/ organizations, other governmental units, and/or other funds. These include investment trust funds, pension trust funds, private-purpose trust funds, and custodial funds.

People-powered Problem Solvers: How to Maximize MIP® for Human Capital Planning

Andrew serves as a member of the FASB’s Not-for-Profit Advisory Committee and chairs the planning committee for the AICPA’s Not-for-Profit Industry Conference. Andrew has served as the chair of the Washington Society of CPA’s Not-for-Profit Committee and co-chair of the WSCPA Not-for-Profit Conference. He is a frequent speaker at conferences, seminars, and webcasts for the AICPA, state CPA societies, and industry groups.

The section was updated to reflect the 2018 legislative changes in the amounts of collected surcharges. Determining whether an activity is different may require the use of professional judgment. Depreciation may be also allocated through a separate indirect expense column. For more information on determining if a transaction is fiduciary please see the Determining Fiduciary Custodial Activities page. These criteria should be applied in the context of the activity’s principal revenue source. Debt backed solely by a pledge of the net revenues from fees and charges. State appropriations for capital acquisitions represents New York State’s appropriations for SUNY construction funding for capital projects on contract college buildings.

Supplies, Services and Other Purchases

This section lists the items your organization owns by the time it would take to make the assets liquid. Cash, an already liquid asset, is therefore listed first in this section. This standard continues the requirement for inclusion of organizations based on the “misleading” criterion, but emphasizes that “financial integration” may also be a component of all of the aforementioned criteria. Additional guidance on evidence of financial integration is also provided in GASB Statement 39.

For-profit primary financial statements include the balance sheet, income statement, statement of cash flow, and statement of changes in equity. Nonprofit entities use a similar but different set of financial statements. Charitable organizations that are required to publish financial statements do not produce an income statement. Instead, they produce a similar statement that reflects funding sources compared against program expenses, administrative costs, and other operating commitments. This statement is commonly referred to as the statement of activities. Revenues and expenses are further categorized in the statement of activities by the donor restrictions on the funds received and expended.

The statement of activities compares and contrasts the net assets of an organization against the income and expenses of a fiscal year. A statement of activities quantifies the revenue and expenses of a nonprofit entity for a reporting period. This is the nonprofit version of the income statement that is used to report the financial results of a for-profit business. The gains an losses resulting from peripheral or incidental transactions or from other events and circumstances that may be largely beyond the control of the NFP; and 2. A business’ profit and loss statement shows income and expenses with either a profit or a loss as a result. GASBCodification Section 2200, Comprehensive Annual Financial Report, requires presenting segment information for certain individual enterprise funds of the governmental entity, including its blended component units.

If a building is shared by several programs, for example, the rent must be allocated using an objective method. An entity has to look at what allocation methodology makes sense to its operations for each expense category. For example, for some entities it may make sense to allocate rent expense based on personnel headcount and for others it may make sense to allocate rent expense based on actual square footage. Each entity has to make these types of decisions based on the nature of their operations. Below is a portion of ExxonMobil Corporation’sbalance sheet for fiscal-year 2021, reported as of Dec. 31, 2021.